Broke, but Not Broken: A Stay-at-Home Dad's Financial Tale

Embark on the financial journey of a stay-at-home dad who swapped a six-figure job for diapers, exploring the balance between parenting, partnership, and a lighter bank account.

Incredibly, here I am, entering month six of my journey as a full-time stay-at-home dad. Yes, you read that right—I willingly bid farewell to my six-figure Corporate America job in September 2023. This transition has been a learning experience in many ways, from diaper-changing acrobatics to mastering the art of negotiating with a toddler. However, one topic has persistently lingered in the recesses of my mind—finances, or as I like to call it, the art of money management.

Upon leaving my corporate gig, I found it challenging to flick the mental switch off, which led me to dabble in several "side jobs." Having been a part of the workforce since the age of 14, two decades of receiving monetary compensation for my efforts had become a hardwired norm. However, in my newfound role as a stay-at-home dad, the concept of income was notably absent, and the absence didn't go unnoticed.

Initially, I took on a multitude of smaller gigs, fueled by the desire to stay active. However, the overwhelming workload eventually pushed me to burnout, forcing a much-needed reevaluation. By the close of 2023, I proudly wore two hats—full-time stay-at-home dad and part-time writer.

Through this journey, I've come to realize the intricate dance between money and contentment. In my former life, I was prone to buying unnecessary "things" simply because I could. An Amazon delivery was a daily ritual. Yet, a January house cleanout served as a revelation—what I had far exceeded what I truly needed. Now, my essentials are limited to new fitness sneakers every few months and, of course, food.

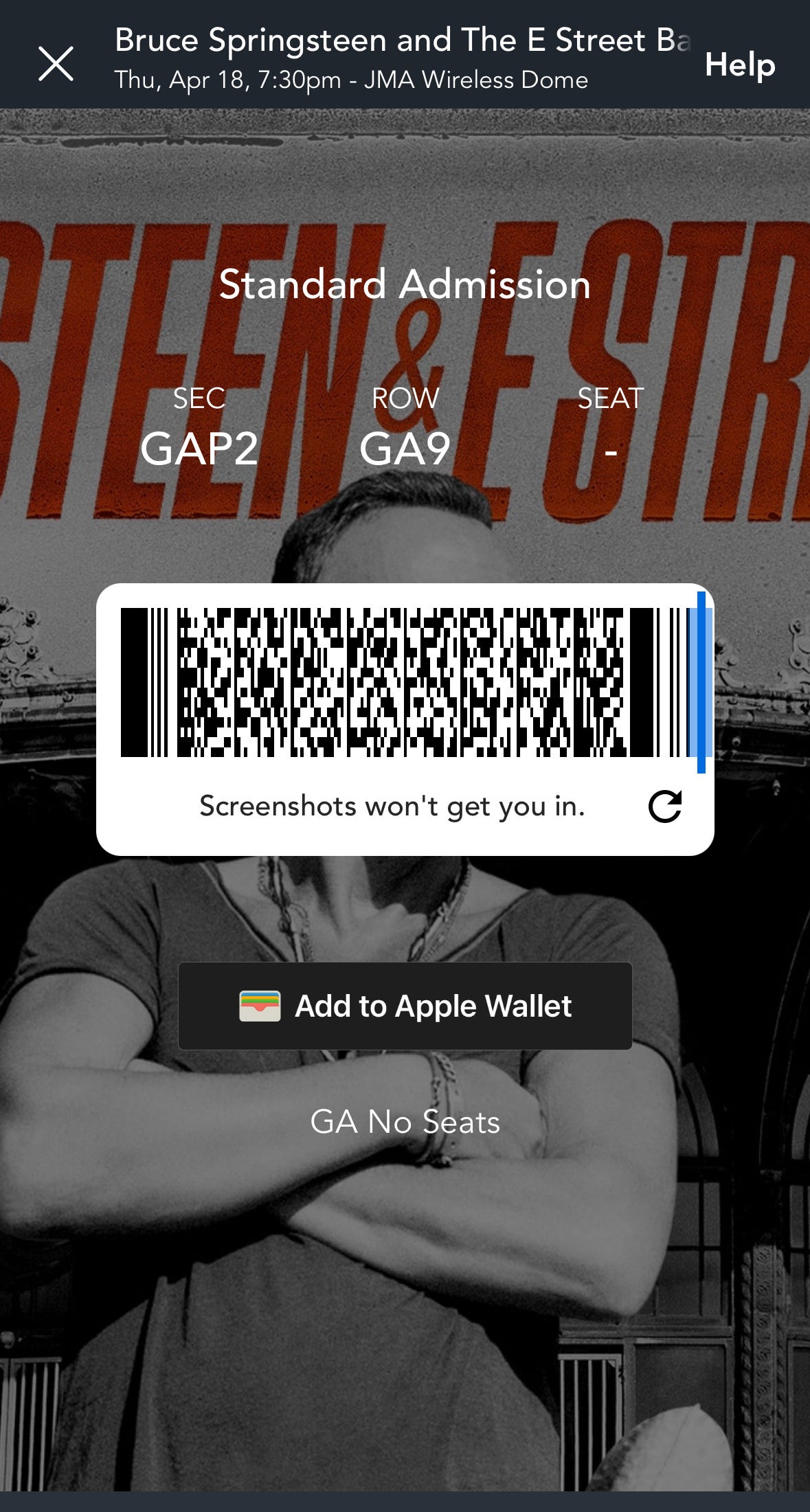

Gratefully, my wife Christine's financial stability provides a safety net for our family. Over the past four years, we've strategically mapped out our spending, initiated investment funds, and crafted an emergency fund. Living comfortably on a single income demands wisdom, not cheapness. We've learned that spending on experiences we value, like concerts and dinners out, is an investment in our happiness.

Speaking of investments, a peek into our accounts recently unveiled a pleasant surprise—we've made a significant amount of money in the first couple of months of 2024, thanks to earlier financial decisions. Although my current endeavors may not bring immediate income, I've effectively set us up for a secure future.

Looking ahead, I ponder my approach to making money. My privilege allows me to pursue writing full-time, with a current focus on a rock 'n' roll novel (which is why it’s been a little quieter here lately). While the financial rewards may not match my previous corporate life anytime soon, I'm optimistic. Querying literary agents to pitch my novel to a major publisher is on the horizon, a step that doesn't diminish my worth as a writer or me as a husband and father. I'm learning that embracing change, seeking support, and charting a course for the future can be as enriching as any six-figure paycheck.

You have always had a gift for writing and it will pay off. It’s good to see you are following your dream. It takes trust in yourself to do what you love . Also you and Christine have a partnership of love & respect for each other; important ingredients for success.